Edquip explained - for Purchasing and Finance Professionals

This page is primarily designed for purchasing and finance professionals who need to ensure that any transactions are compliant, secure and beneficial. By reading this page you will understand how Edquip works and get help and pointers for your due diligence.

Edquip is a marketplace for technical training equipment, designed as a trust-by-default system which reduces the risk of international procurement for both the buyer and the seller.

Below we explain the functionality on a high level, if you want to go deeper into detail then see our Standard Operating Procedures (SOP) or contact us for any questions.

Index, click on any of the links below for short-cut:

- International Procurement Risk

- What is Escrow?

- Examples of Escrow

- Escrow with Milestones

- Payment Service Provider (PSP)

- Customer dashboard

- Trust by default system

- For Due Diligence

- Customer support contact details

1. International Procurement Risk

When a seller and a buyer of goods are in different countries the transactional risk increases. The buyer wonders “will I receive the product I pay for?” and the seller wonders “will I get paid for the product and services I deliver?”.

Typically, the seller would like to receive full payment of products and services before delivery, but the buyer does not want to pay until they have received these products and services.

This standstill leads to at least one party, or maybe both will have to take more risk than necessary.

But it does not have to be this way.

2. What is Escrow?

“Escrow is when a bond, a deed, or payment funds are kept in custody of a third party and taking effect only when a specified condition has been fulfilled.”

This means that the buyer can pay to a third party, which confirms to the seller that funds are received, and the seller then delivers agreed upon products and services to the customer, whereafter it gets paid from the third party.

3. Examples of Escrow

An escrow agreement can look different depending on the transaction, three examples below:

- Online high value transactions, such as vehicles, expensive watches, or high-end designer handbags. Physical delivery of product conditions the payment.

- Service based transactions, such as website or software development, freelance work or consulting delivery. Partial or final delivery of services conditions the payment.

- Face-to-face high value transactions, such as real estate transactions, or purchase and sale of companies. Legal ownership transaction conditions the payment.

At Edquip we use a combination of the above three types of escrow, in a standardized process.

4. Escrow with Milestones

To reduce the risk for both Customers and Vendors, the Edquip transactions are designed with pre-defined milestones so that payment is released only “as-and-when” the Vendors reach these milestones, which is the condition for payment. Let’s explore the different milestones below.

Hardware products

In the table below you can see that only after Edquip has confirmed payment has been deposited by Customer (Milestone 5), the Vendor initiates manufacturing of the order (Milestone 6). This approach reduces the risk for the Vendor.

Further, you can see that the Vendor only gets paid “as-and-when” they reach different milestones, with the majority payment once the Customer has confirmed receipt of order, and approved Installation, Commissioning and Training (ICT). This approach reduces the risk for the Customer.

Software products

Since software products do not need to be physically shipped, these milestones are fewer.

Once Edquip has confirmed that payment has been deposited by Customer (Milestone 5), the Vendor onboards the Customer (Milestone 6), whereafter they get paid (Milestone 7).

This approach reduces the risk for both the Customer and the Vendor.

5. Payment Service Provider (PSP)

Edquip has partnered with a government regulated Payment Service Provider (PSP) to provide the digital payments infrastructure, to authenticate Vendors, to hold on to escrow funds, and to pay out escrow funds as directed by Edquip.

For this purpose, Edquip has appointed the payment service provider Mangopay S.A. – which is an Electronic Money Institution (EMI), regulated by the relevant financial authorities, and compliant with relevant EU regulations for the financial sector (see due-diligence section below for more info).

At any point in time, Edquip does not have access to the escrow funds, but can only direct “how much and when” should be paid out to the Vendor, as explained per the milestones above.

In the unlikely event that Edquip or the PSP goes bankrupt, creditors of neither of these entities will have access to the escrow funds, since they are legally held on behalf of a third party.

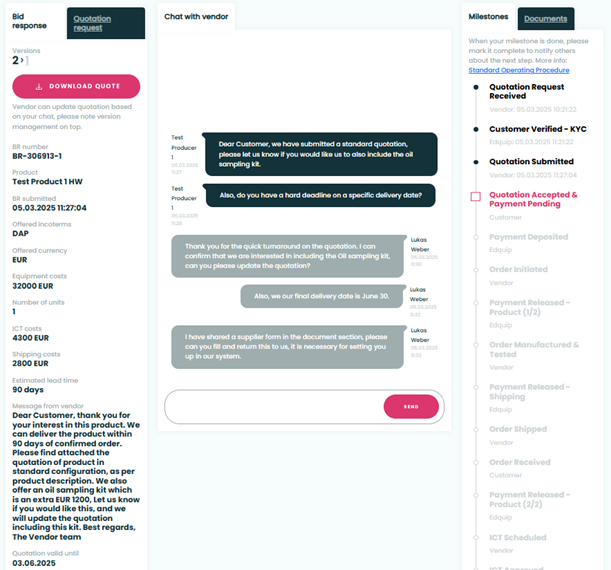

6. Customer dashboard

At Edquip we have designed a Customer Portal, where users of the Customer can manage and download quotations or pro-forma invoices, communicate with the Vendor for product configuration, see and act upon the Milestones, and share any necessary documents.

The Edquip Milestone system standardizes the transaction, while still allowing for flexibility for the Customer and the Vendor to agree to different terms.

The person who requested quotations can invite their colleagues from Purchasing or Finance to collaborate with the Vendors directly in the Customer portal.

7. Trust by default system

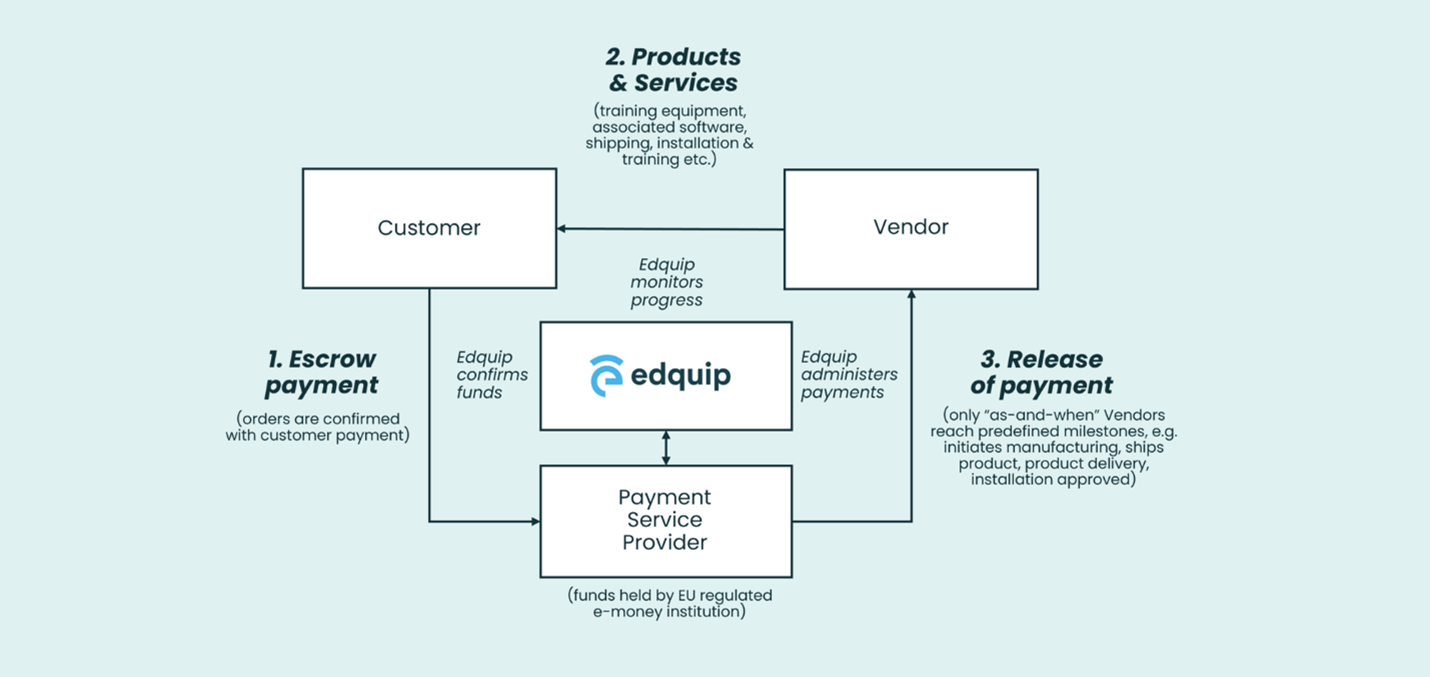

Using Escrow, Milestones, a PSP, and a comprehensive suite of software functionality Edquip has designed a “trust by default system” which makes education procurement easy.

Below you can see a diagram placing Edquip as a marketplace in the middle of the Customer, the Vendor and the PSP, orchestrating the transaction in a safe and secure manner.

The result is that the Vendor is happy because the funds are secured in Escrow, and if they provide their side of the agreement (delivering products and services) they will get paid.

Simultaneously, the Customer is happy because they do not have to send all the money upfront to the Vendor, instead the Vendor will have to deliver the products and services before getting paid.

8. For Due Diligence

Below are some details which should help with your due diligence. If you have any questions, please do not hesitate to reach out.

Edquip

Edquip Paltforms s.r.o. is a limited liability company having its registered office at Zerotinova 1144/40, 13000, Prague 3, Czech Republic, and it is represented by Timo Wohlin-Elkovsky.

Edquip is incorporated with the municipal court in Prague 1 under the filing number C362365 and with Czech financial authorities with the tax and VAT identification number CZ14299691.

- You can access and download (Czech language only) the proof of incorporation from the Czech Ministry of Justices website here, or contact us for an official translation into English.

Payment Service Provider (PSP)

MANGOPAY S.A is a limited liability company incorporated in Luxembourg, with a share capital of 27.201.000 euros, having its registered office at 2 Avenue Amélie, L-1125 Luxembourg, registered under Number B173459 on the Luxembourg Trade and Company Register and approved as an Electronic money institution by the CSSF, Commission de Surveillance du Secteur Financier, 283, route d’Arlon - L-1150 Luxembourg.

- You can find the Mangopay website here.

- You can access and download the proof of incorporation from the Luxemburg Business Register here.

- You can also verify Mangopay S.A. with the EBA’s (European Banking Authority) payment institutions register here.

Vendors

Edquip only partners with well-established and highly reputable Vendors of training equipment to list and sell their products on our marketplace.

Further, Mangopay S.A. is mandated to comply with European legislation of Anti Money Laundering (AML) and Counter Terrorism Financing (CTF), every Vendor must pass Know-Your-Business (KYB) with MANGOPAY S.A. to receive payments through the Edquip marketplace. This is a rigorous process, the same as for a company to become a customer of a bank.

Finally, if you would like to make a credit check of the Vendor, please use the legal name as stated on your quotation or pro-forma invoice, since this could differ from the “brand name” of the company (e.g. our brand name is “Edquip”, but out legal name is “Edquip Platforms s.r.o.”).

9. Customer support contact details

If there is something which is not clear for you as a Customer, or if you have some questions, please do not hesitate to reach out to us.

We are open during 9am to 6pm Central European Time (CET) and you can reach us via the contact form in the header, via email (info@edquip.co) or by phone as per below:

- (US) +1 813 644 3927

- (UK) +44 116 218 8101

- (CZ) +420 777 036 056

You can also book an online meeting with us: cal.com/edquip or send us a message on the below form.

We look forward to hearing from you!

Save Time and Money!

Are you looking to procure technical training products? Curious to learn more about the benefits of using Edquip?

About Edquip Platforms s.r.o.

Are you looking for information about our company and activities? Click the button below: